Deduct 100% of Your Equipment Investment in 2025

Explore eligible equipment

If you plan to upgrade your production equipment, now is the time!

New legislation makes 100% bonus depreciation a permanent part of the tax code. That means every wide-format printer, laminator, or finishing system you purchase from LexJet this year may qualify for a full deduction on your 2025 tax return***.

This recent change in federal tax law allows businesses to fully deduct qualifying equipment purchases in the same year they are made—including eligible software like RIP systems, as long as it meets IRS guidelines for depreciable property. This creates a smart opportunity to invest before year-end.

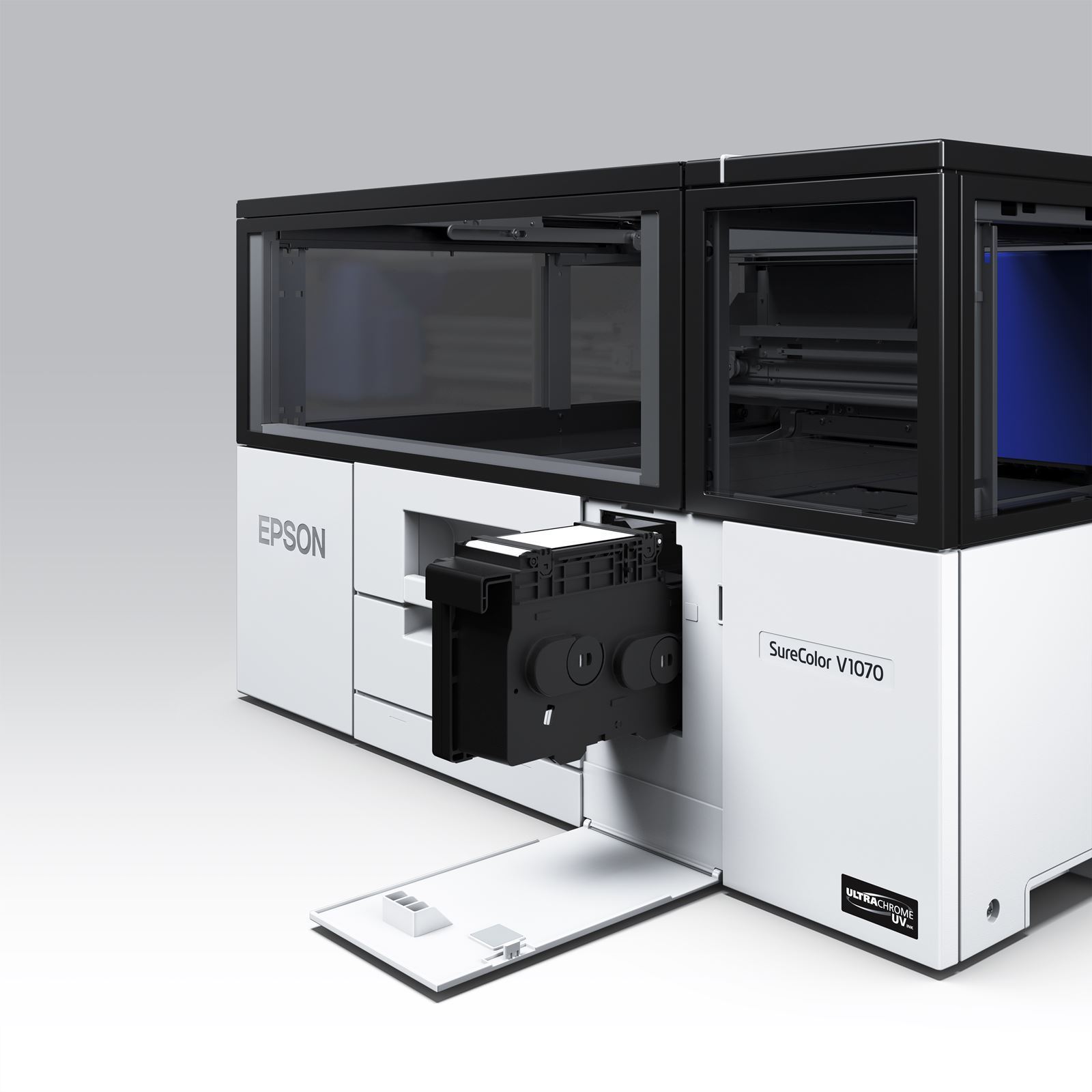

- Wide format printers from Canon, EFI, Epson, HP, and Mimaki

- Latex, UV, aqueous, and solvent print systems

- Laminators and finishing equipment

- Color management tools and RIP software*

DISCLAIMER

*** Consult your tax advisor to determine how these deductions apply to

your specific business. Tax laws vary based on business structure and

location.

* Software may qualify if it meets IRS requirements for depreciable

property, including licensing, availability, and usage criteria.

EXAMPLE

NEXT STEPS

LexJet equipment specialists can help you select the right solution and explore available financing. To take advantage of the full deduction, equipment must be placed into service by December 31.